Key takeaways:

- India is planning on launching a carbon market of its own. It is likely to build off existing market-based mechanisms – PAT and RECs. This could cover nearly 65% of the country’s emissions

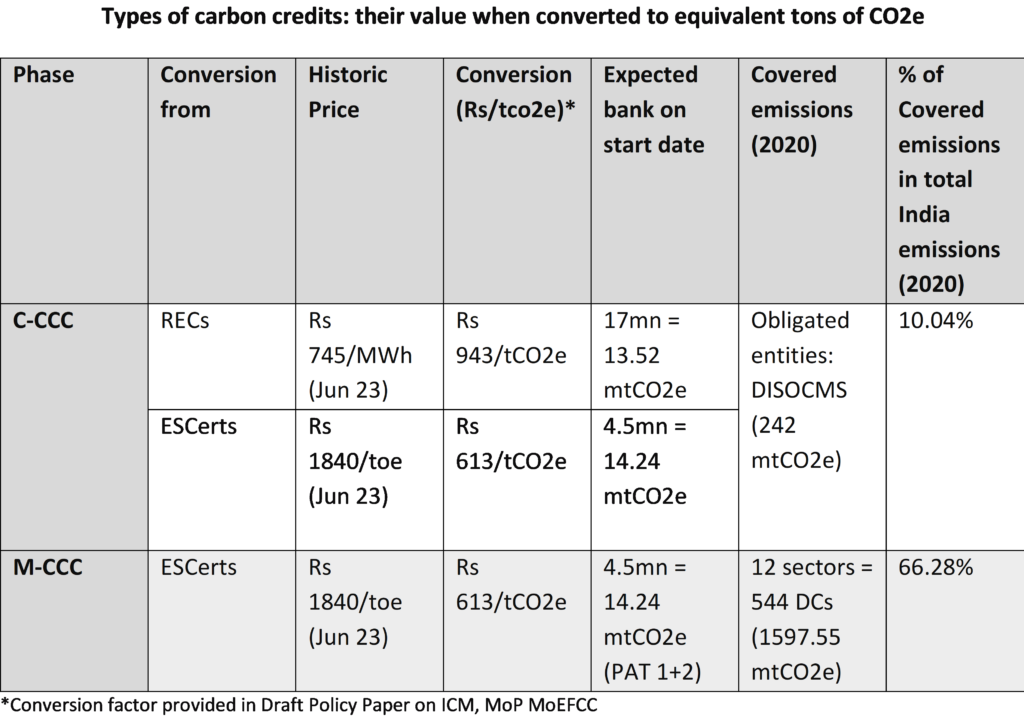

- Three kinds of carbon credits are envisaged as per the discussion paper floated by India’s Bureau of Energy Efficiency

- Converted Carbon Credit Certificates

- Mandatory Carbon Credit Certificates

- Offset Carbon Credit Certificates

- The initial carbon price signal is likely to be in the range of Rs 600- 1000 per ton of CO2e, which is similar to carbon prices of programs such as RGGI and the ETS in China.

India planning on launching a carbon market of its own

India presently has an annual emission of 2.8 billion tCO2e and currently lacks a formal carbon market. Recently the government passed the Energy Conservation (Amendment) Bill, 2022 legislation to set up one.

Bureau of Energy Efficiency is the nodal agency tasked with setting up this market. The carbon market is likely to build on mechanisms to regulate energy consumption and promote cleaner energy sources. The Perform, Achieve, and Trade (PAT) program and Renewable Energy Certificates (REC) are two significant market-based approaches which cover over 65% of the country’s emissions.

Institutional capacity created by past programs

Over the past decade, India has successfully implemented the PAT and REC schemes, establishing institutional capacity for market-based approaches. These schemes have processes for recording, reporting and verification: all of which are necessary in a carbon market.

Energy saving certificates: Perform, Achieve and Trade (PAT) scheme

The PAT scheme focuses on reducing energy intensity in energy-intensive industries through the accelerated adoption of energy-efficient and low-carbon technologies. It sets mandatory energy intensity targets for designated consumers (DCs) based on their performance within their sectors. DCs are given specific energy consumption targets (SEC) to achieve within a three-year cycle. To encourage energy conservation, DCs can earn Energy Saving Certificates (ESCerts) for surpassing their targets, while those falling short must purchase ESCerts from the market. These certificates can be traded on a dedicated platform by Indian Energy Exchange (IEX) and Power Exchange India Limited (PXIL).

Renewable Energy Credits in India

The Renewable Purchase Obligations (RPOs) in India require each state to achieve a specific percentage of renewable energy in their power generation. To meet these obligations, the Renewable Energy Certificate (REC) trading scheme was introduced in 2010. This nationwide market allows Indian states to trade renewable energy certificates measured in megawatt-hours (MWh) to fulfill their RPOs. The Central Electricity Regulatory Commission (CERC) issues RECs to generating companies, which can then be traded on approved platforms like IEX and PXIL. This scheme enables states with limited renewable potential to include renewable energy in their procurement by purchasing RECs from states with higher renewable energy capacity.

Three kinds of carbon credits are envisaged

As per the discussion paper floated by India’s Bureau of Energy Efficiency, the Indian Carbon Market (ICM) will build on the existing PAT and REC schemes.

Obligated sectors currently involved in the Perform, Achieve, and Trade (PAT) and Renewable Energy Certificates (RECs) markets will retain their obligations. Additionally, the ICM aims to attract other sectors not covered by PAT or RECs for offset trading. The ICM is expected to take off in two phases.

Phase I (2023-2025)

Phase I aims to incorporate the current PAT and REC mechanisms into a carbon market system. The PAT cycle, presently lasting three years, will be reduced to one year under the new ICM. During this phase, obligated entities under PAT and RPO will maintain their existing energy efficiency compliance framework. They will achieve energy targets through ESCerts and RECs respectively. Any surplus ESCerts and RECs generated will be converted into carbon credit certificates, available for voluntary purchase by non-obligated entities, facilitating certificate trading through the offset scheme. Specific criteria for eligibility and conversion factors are still under development.

Additionally, during Phase I, the PAT scheme will be active, and efforts will be made to establish the offset market, develop MRV guidelines, set up a registry, and create a comprehensive governance structure for both offset and compliance markets in consultation with relevant stakeholders.

Phase II (2026 onwards)

During Phase II, ICM will transition from an energy efficiency compliance market to a carbon compliance market. Obligated entities will receive GHG intensity reduction targets and fulfill their obligations through trading mandatory carbon credit certificates (M-CCC). Entities will monitor, report, and verify their emissions to comply with the Carbon Credit Trading Scheme. Targets will align with India’s NDC trajectory, and sectors may be added to the compliance market. The PAT scheme’s three-year cycle will become an annual compliance cycle. RECs will still fulfill the RPO. Phase II aims to transform India’s market into the Carbon Credit Trading Mechanism, and the ICM will include international mechanisms and develop comprehensive GHG reporting guidelines for all sectors.

The following 3 types for carbon credit certificates are envisaged

- Converted Carbon Credit Certificates (C-CCC)

- Mandatory Carbon Credit Certificates (M-CCC)

- Offset Carbon Credit Certificates (O-CCC)

Comparison with global price signals

Indian RECs and Indian ESCerts have been compared with other global programs in the above chart. The prices of all the instruments have been standardized into Rs per ton CO2e. The Rupee values above are in nominal terms. And the exchange rate for other global instruments has been the average prevailing exchange rate for the year in which prices are compared. Furthermore, to standardize the denominator, the following assumptions were made:

- Million tons of oil equivalent (used in Energy Saving Certificates) was converted to CO2e using a factor of 3, which is the same figure used by Bureau of Energy Efficiency in its draft policy paper.

- For determining the emissions displaced by the RECs, the grid emission factor for the year has been applied

Observations that emerge:

- ESCerts are similar to RGGI and China. And this is inspite of the oversupply of ESCerts and relatively lose targets historically

- Indian REC prices when converted to carbon equivalent are at par with global REC markets (when equated for CO2e)

- Higher than Texas RECs

- But lower than PJM RECs.

A key implication of the above is that Indian industry has a capacity to absorb current global carbon prices without disruption since it has already been bearing those costs.